The Extractive Potential of Residual Rent: Effects of Touristification on the Historic Center of Napoli / 2

PROJECT DESCRIPTION

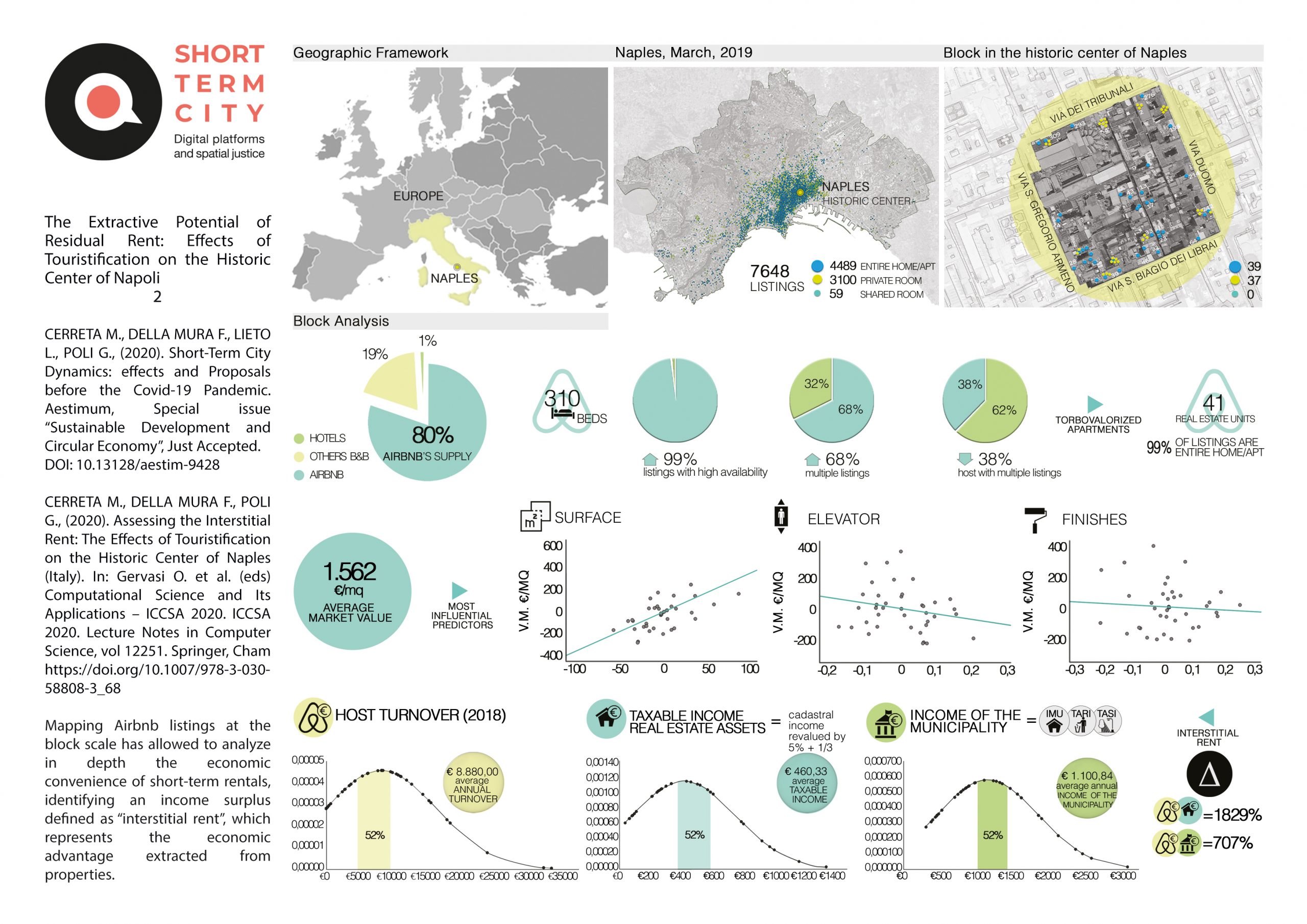

By looking at individual listings we refined aggregated data and found out that 99% of the listings refer to an entire apartment, for a total of 41 real estate units present on the platform. The presence of 38% of hosts that publish multiple listings shows the growing trend to profit from second homes.

The data about 41 real estate units have been crossed with the cadastral data to obtain information relating to the building category, the number of rooms and average income.

Through multiple regression analyses, it is possible to understand what determines the actual market value. In this case study, the most influencing factors are surface, elevator and finishes.

Traditional market values are quite low compared to extractive values. By comparing the 2018 turnover data of the hosts with those of the taxation regime to which the properties are subject, the properties produce a surplus of income – the “interstitial rent” – equal to 707%.

PROJECT DETAILS

Author: M. Cerreta, F. Della Mura, L. Lieto, G. Poli

Date: 2020

DOWNLOAD

![]() The Extractive Potential of Residual Rent_2 jpg

The Extractive Potential of Residual Rent_2 jpg